How does the KYC crypto process look like? Find out with BreachDirectory.

Introduction

A KYC crypto process is a necessity for many financial institutions and a known process for many. How exactly does it look like and why? Find out with BreachDirectory.

What is a KYC Crypto Platform?

In simple words, KYC crypto is short for an identity verification process known as Know Your Customer: it is an abbreviation for a legal requirement that every exchange has to adhere to to verify the identity of their customers. KYC crypto can be thought of as a precaution that helps exchanges ensure the legitimacy of the money in the possession of the customer, ensure that the money isn’t obtained by illegal means or used for or as a result of tax evasion schemes.

In many KYC crypto exchanges, the Know Your Customer (KYC) process is often the first stage of an anti-money-laundering (AML) process.

How Does the KYC Crypto Process Look Like?

In many crypto exchanges, the KYC crypto process is usually completed via a couple of steps:

- A customer registers on a crypto exchange or any other platform necessitating the completion of a KYC crypto process.

- The customer is enabled to perform a limited number of financial operations until a KYC crypto alert is issued and the customer is asked to verify his or her identity.

- Once the customer provides his information to the KYC crypto platform, the platform then verifies the customer’s identity against official databases that contain information on criminals, Politically Exposed Persons (PEPs), sanctioned individuals, and the like.

What Happens After a KYC Crypto Process?

After a KYC process is completed, many cryptocurrency exchanges continue to monitor the activities of their customers for potential money laundering or tax evasion schemes: any suspicious or unusual activity is then immediately reported to regulatory authorities. At the same time, keep in mind that there are two types of cryptocurrency wallets – these can be either custodial or non-custodial (non-custodial wallets are self-hosted wallets.) In this case, only custodial wallets must comply with KYC crypto practices.

How to Protect Your Privacy?

Know Your Customer (KYC) processes aren’t there without a reason – they’re there to protect us from sanctioned people and criminals. With the anonymity of cryptocurrencies in mind, it’s no wonder that many users of KYC crypto platforms are also concerned about their safety and privacy on the web: with more and more people entering the cryptocurrency world every year, there’s no telling about what kind of financial damage might be done to the victims.

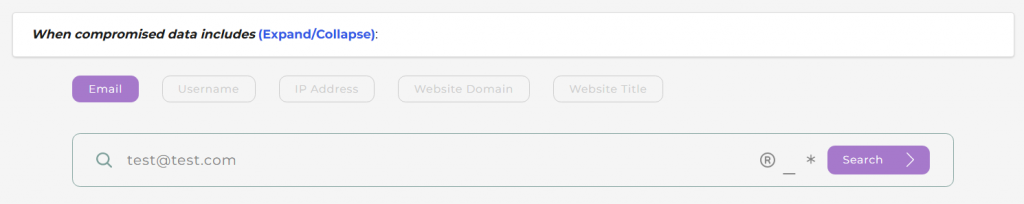

At the same time, there are things that you can do to protect yourself. Enter BreachDirectory.com – a data breach search engine protecting tens of millions of people: search for your username, email, or IP address, and it will tell you whether this data was exposed in any data breach and at the same time provide you with actionable advice if you find that any of your data is stolen.

BreachDirectory will not only let you scan your online accounts through hundreds of data breaches to help you determine if you‘re at risk but also help you be informed about when your online data has been exposed – for that, register for data breach notifications and be informed on what‘s happening with your data every month.

Alternatively, if you are a developer, consider making use of the BreachDirectory API to implement the data inside the BreachDirectory.com data breach search engine into your own application to further your use case.

At the same time, you should also be wary of impersonators: the only original domain belonging to BreachDirectory is BreachDirectory.com. Everything else is fake and/or plagiarized.

Summary

The Know-Your-Customer process, or KYC for short, is a regulatory process of interest to many financial institutions and KYC crypto exchanges. This process ensures that a customer using a financial board (e.g. a crypto exchange, an application provided by a bank, etc.) is not sanctioned, is not sought after for tax evasion and/or money laundering or other crimes, and so on.

At the same time, the KYC process isn’t the holy grail – while it can help alleviate some problems for exchanges, it is often time-consuming. Privacy-conscious individuals should also make use of things like data breach search engines, the BreachDirectory API, and other appliances.

FAQ

What is the KYC Crypto Practice?

The KYC verification practice is a Know Your Customer process that’s in place in all exchanges dealing with money, no matter if they’re related to cryptocurrency or not. This practice ensures that the person using the service dealing with money is not of interest to law enforcement agencies and is safe to deal with.

Why Should I Use BreachDirectory.com?

Consider using the data breach search engine available at BreachDirectory.com to keep in the loop regarding your account and its appearance in any public data breaches. The data breach notification feature can be useful to be notified about when your account appears in a data breach.